The trading world is constantly evolving and what worked 2 or 3 years ago might not be effective now. Therefore, a great course must include current strategies and knowledge that you can use in practical trading. You’ll spend the first few hours learning the basics of inferential and descriptive statistics needed for the course. Mesmerizing world of quantitative finance, then this is the course for you! There are few courses that go as deep into the subject as this one here and touch on topics that will have you scratching your head for a while (as it should be). But the reward for all your effort will be equally satisfying as you crack the deepest mysteries of the equity markets using your newly acquired quantitative toolbox.

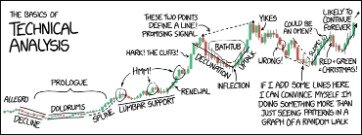

- We research technical analysis patterns so you know exactly what works well for your favorite markets.

- All the courses in our roundup meet those criteria, but the benefits vary for individuals with different experience levels, learning styles, and budgets.

- Furthermore, Udemy’s The Complete Options Trading Course is designed to turn you into a successful options trader in a very short period of time.

- It takes a little over 30 minutes to complete the course, and you’ll receive a certificate of completion when you reach the finish line.

- Technical analysis is a term used to define the process to predict market price movements on scope and demand & supply of the market.

In addition to charts, technical analysts also use indicators and various theories to forecast the direction of prices through the study of past market data. Technical traders believe that current or past price action in the market is the most reliable indicator of future price action. Instead, technical traders only look at a stock chart to analyze its past price movements and try to predict what will happen next. Used by finance professionals, technical analysis looks at past market data to make predictions about future performance. Analysts use these indicators to make sense of price movements, predict timelines, and understand market volatility. Straightforward Technical Analysis for Beginners is facilitated by a forex and cryptocurrency trader.

Careers in technical analysis

Know how to evaluate indicators and patterns based on quantitative analysis. Students do not need to have any pre-existing knowledge before opting for the course. The program will help students learn how to analyze stocks, cryptocurrencies, forex, commodities, index, and options. Learn about risk management and know-how to avoid common mistakes made by new traders. Understand how to make a new source of passive income and identify patterns in charts. Know about trading psychology and how to be rational while making trade decisions.

It can be a bit tricky for new investors to correctly apply technical analysis as part of their investment strategy and that often leads to sub optimal results. For technical analysis to yield meaningful results, you have to do it right. Countless trading books have been authored and some on technical analysis have withstood the test of time and are go-to resources for novice traders. Also, many courses are also available on and offline, including Investopedia Academy’s Technical Analysis. Stock Technical Trader is your place to gain access to everything related to the stock market. You’ll get instant trade alerts, a live trading chat room and videos to help you build a stronger technical analysis foundation.

Instead, technical analysis reviews price patterns and charts as a way to predict the future. Stocks are not only driven on the underlying companies financial performance; human behavior, fear, and greed also fuels the market. Many trading courses offer technical analysis classes as part of their curriculum, and some are very good. We chose to target trading courses that focus on technical analysis because it is a specialized part of the trading process. In our initial search of technical analysis courses, we found more than 20 U.S.-based online courses.

List of Best Technical Analysis Courses: Find The Right Fit For You

Technical Analysis is all about using mathematics, statistics and other quantitative methods to see patterns in stock price, volume and other data. It is by no means an easy discipline to master, but with the right strategy, it can be a game changer when it comes to picking the right stocks at the right time. Which is why some of the largest funds and investment firms use technical analysis to make their investment decisions.

USD/JPY Technical Analysis: Strengthening of Bullish Path – DailyForex.com

USD/JPY Technical Analysis: Strengthening of Bullish Path.

Posted: Mon, 15 May 2023 07:00:38 GMT [source]

Depending on your skill level and prior knowledge, choose technical courses that meet you where you are. Some courses provide direct feedback on your skills, whereas others teach you through readings or videos. Not only is the brokerage well known and respected, it is also a fantastic educational platform. TD Ameritrade offers “swim lessons” which cover a wide range of investing and trading topics.

In this blog, the topics like what is technical analysis and what are the different components of technical analysis are covered. In addition, we have also noted certain https://trading-market.org/ that would help you in becoming a professional trader. We hope the best technical analysis courses blog will help you in learning technical analysis in a simplified way. Candlesticks Trading for Beginners is one more excellent course for beginners on Fingrad to learn in detail about candlestick patterns.

IFMC has given the opportunity to students, investors and traders outside Delhi to learn Technical Analysis of stocks in a simple way. You’ll master how to use dozens of technical indicators, oscillators, candlesticks, and chart patterns so you can predict exactly what’s going on with the market you’re trading in. Udemy’s Advanced Technical Analysis – Part 1 is another remarkable technical analysis online course for traders. Udemy’s Advanced Technical Analysis – Part 1 covers every stock trading concept in detail. Udemy’s Master “Technical Analysis and Chart Reading Skills” Bundle is among the list of the best technical analysis online courses for many good reasons. After that, the bundle makes you an expert in technical analysis, volume analysis, and chart reading.

Your Tool Kit to Become Successful Technical Analyst

Additionally, learn a variety of techniques for understanding the market psychology of smart investors. In addition to how the stock market responds including live trading examples. Technical analysis is a tool used to study and predict the probable future price movements in the financial asset by analyzing the historic prices, past trends, and market data. The components mainly used in technical analysis are Price and volume. Different chart types are presented and important charting concepts are explained from a practical perspective.

If you’re looking to day trade or swing trade stocks, you’ll need to familiarize yourself with technical analysis. Without question, technical analysis takes some time to learn and get accustom to. Luckily, there are plenty of online courses that can bring best technical analysis courses you up to speed. Its educational library consists of courses, reference materials, and educational videos. With its seven modules and 40 lessons of on-demand video content, the beginner’s course ranks high as one of the best free course offerings.

In addition to studying patterns and indicators, you need to master behavioral economics and risk management. The more knowledge and practice you have, the more confidence you gain. The best way to get there is with a quality technical analysis trading course. Technical analysis trading model discusses a methodology for forecasting the direction of price chart on Intraday and Positional Trades.

Master’s Degrees

For courses that don’t, you can sign up for a demo trading account, such as TD Ameritrade’s thinkorswim platform, which allows you to practice trades and backtest them to see how they might have performed over time. The idea is to experience trial and error and build your confidence without actually risking any money. Having access to top-tier charts and analysis tools is critical for applying your knowledge.

- Instead, technical analysis reviews price patterns and charts as a way to predict the future.

- Hundreds of experts come together to handpick these recommendations based on decades of collective experience.

- This course reviews those patterns, discusses how to identify the patterns and supplements this with concepts form behavioral finance to explain why the patterns are predictive.

- You want to go on a journey through the material, gathering skills as you go.

The course also attracts people who aspire to learn options trading and effective options trading strategies in a very short period of time. To cope with the complexities and risks involved in trading, technical analysis is the best tool for traders. Therefore, it is important to learn about technical analysis before starting trading. You cannot expect to hit success without learning about technical analysis. Technical analysis is used for forecasting or speculating about the future price movements of virtually any security that is affected by forces of supply and demand.

After the completion of this class, you can go for the more advanced programs on the platform. Check out our compilation of Best Financial & Capital Markets Courses. The stock trading program will teach students about concepts like time frames, noise, indicator-based trading, and price momentum.

IFMC’s Technical Analysis online course certification focuses on 100% confidence while trading in live market by traders, investors, relationship managers, advisors & technical analyst. IFMC’s Technical analysis online certification course teaches traders and investors in a simple way how to read line charts, candle charts & understand basic concept of demand and supply. Technical Analysis course by IFMC teaches how to read trend in live market, calculate support & resistance in NIFTY & STOCKS. Various theories like Dow, Elliot, Candle patterns, Doji and other technical tools like MACD, RSI. The course module not only intends to prepare students for the NSE examination – NCFM series. Technical analysis is a term used to define the process to predict market price movements on scope and demand & supply of the market.

– The beginner-level programs do not require any prior experience in this field. CourseMarks, which helps students find the best classes based on student feedback and content freshness and diversity, gives the Technical Analysis Masterclass a rating of 9.8 out of 10. Investopedia offers its own technical analysis course as part of the Investopedia Academy, but to maintain objectivity, we opted to exclude it from this roundup.

Gold Technical Analysis: Gold Price is Still Strong – DailyForex.com

Gold Technical Analysis: Gold Price is Still Strong.

Posted: Mon, 15 May 2023 11:00:33 GMT [source]

This is the bread and butter of algo trading using technical signals. After learning the ins and outs of technical analysis, the next step is to take the principles from these courses and apply them in practice through backtesting or paper trading. Many traders develop their own trading systems and techniques over time. After all, companies offering “off the shelf” trading systems that yield consistent profits probably wouldn’t be selling them if they were indeed profitable (they would keep the secrets to themselves).

This particular course focuses on the fundamentals of technical analysis. There is a lot of very detailed information in there and some of these concepts can be very complex. But to their credit, the instructors manage to explain these crucial concepts and theories in a way that is engaging and approachable. Technical analysis can provide a new set of concepts and tools for traders to utilize.